Share this post

HS Codes: How to make a Harmonized Code lookup

Everyone involved in the trading of beverages wants to get their wine to its destination on time. Getting the paperwork right the first time, every time, is essential for a smooth delivery, and choosing the correct HS Code for your shipment is something you can’t overlook. In this article, we will look at everything you need to know about how to make a Harmonized Code lookup and how to use HS Codes correctly.

What is an HS Code, and why are they used?

An HS Code is a globally recognized six-digit identification code used by governments to identify, record and control goods sent internationally. HS stands for Harmonised System and the code was developed by the World Customs Organization (WCO).

In the wine business, Hillebrand Gori uses them to provide information about the type of wine they are shipping in a universal format that is accepted by all countries using the system. In a nutshell, knowing how to make a Harmonized Code lookup keeps everyone involved in the trading of wine on the same page when it comes to paperwork.

HS Codes also allow us to know:

The cost of import duties, VAT, and other charges.

If any preferential treatment applies.

If any restrictions or prohibitions apply.

The HS Code list covers around 5,000 categories. It is divided into 21 Sections and 99 Chapters. Further headings and subheadings allow for more specific categorization. The six-digit HS Code is used to locate your wine on this list. The first two digits represent the chapter, the next two digits are the heading, and the last two give the subheading.

Let’s use the WCO Harmonized System webpage to find the HS Code for your wine. For example, if you are shipping a Spanish wine, a Rioja, this is what you have to do:

Look at Section IV which includes ‘Beverages, Spirits And Vinegar’.

Go to Chapter 22 ‘Beverages, spirits and vinegar’.

Click Heading 04 ‘Wine of fresh grapes’.

Go to Subheading 21 ‘Other wine’.

If you look at Rioja you’ll see it has HS Code 220421.

Harmonized Code lookup: are HS Codes a globally recognized way to classify wines?

HS Codes are used by authorities in 212 countries around the world to label and categorize more than 98% of internationally traded products. However, countries can add more digits to the original six-digit code if more detailed classification is required by their own internal legislation. HTS Codes, CN codes, TARIC Codes, and similar systems are forms of HS Code used in different markets.

HS Code lookup: What’s the difference between HS Codes, HTS Codes, CN codes, TARIC Codes, and Commodity Codes?

Each country will have its own guidelines for how to import beverages and the process you follow when making a Harmonized Code lookup in order to find and assign your HS code. Below is an example of how the US and the UK set out their guidelines.

US HS Codes

To import wine into the US, you have to use the HS Code plus four more digits to make what is called a Harmonized Tariff Schedule (HTS) code. The HTS Code allows you to estimate the duties you will need to pay if importing wine into the US. Exports from the US need a 10-digit code called a Schedule B Number. The Harmonized Tariff Code lookup tool is available on the U.S. International Trade Commission webpage.

EU HS Codes

In the EU, an eight-digit HS Code called the Combined Nomenclature or CN code is used for wine exports. The seventh and eighth digits identify the subheadings in the CN system.

Regarding the TARIC Code, it is necessary for the importation of wine from outside the EU. This is the CN code plus extra digits required by EEA regulations. You can check the TARIC Code on the European Commission website.

UK HS Codes

For imports into the UK, you need to use a seven to 10-digit Commodity Code. The extra digits are for use within the UK Customs Tariff system.

How to make a Harmonized Code lookup for a UK HS Code

Let’s have a look at how you can find the UK HS Code we just mentioned:

Go to the UK Trade Tariff page.

Click on Section IV.

Click on Chapter 22 which lists ‘Beverages, spirits and vinegar’.

Here you can see nine headings. Heading 04 is the one we are primarily interested in.

Let’s click on Heading 04.

Now you have a lengthy table with these subheadings:

Sparkling wine.

Other wine.

Other grape must.

You can see that all the Commodity Codes begin with 2204. This is because you are looking in Chapter 22, Heading 04 of the Customs Tariff. This also matches the universal HS Code system.

Note that wines are grouped into different subheadings according to properties, such as:

Container size

Bottled or in bulk

Storage requirements

Origin

Color

Alcoholic strength

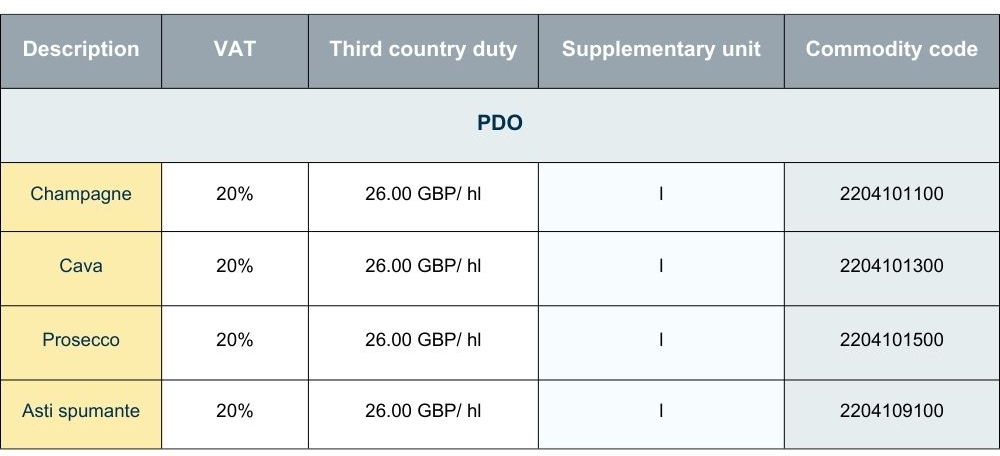

The first subheading is for sparkling wine, with a further subheading for wines with a Protected Designation of Origin (PDO). Here you find this table:

Note that the Commodity Code for sparkling wines begins with 220410. The code shows our wine is listed under Chapter 22, Heading 04, Subheading 10.

The last four digits are UK-specific and determine the duty applicable.

Below the tables are many footnotes with essential details about the classification criteria.

Why are HS Codes important to get right?

Using an incorrect code can be viewed as misleading, non-compliance, or misdeclaration by customs officials. If a wine shipment is inspected anywhere on its journey, and they find the code does not accurately describe the contents, it can result in serious consequences such as:

Penalties for non-compliance.

Delay or seizure of shipments.

Underpayment or overpayment of duties or taxes.

Loss of import/export privileges.

Loss of free trade agreement opportunities.

Incorrect utilization of Free Trade Agreements.

An HS Code may be just a short string of numbers, but the success of your wine shipment depends on getting it exactly right. Navigating the labyrinth of HS Codes, TARIC Codes, Commodity Codes, HTS Codes, and Schedule B numbers can be tricky. You may want to consult with an expert freight forwarder such as Hillebrand Gori to help make a Harmonized Code lookup. Hillebrand Gori specializes in the global transport of wine, beer, and spirits. We have offices in every market where wine is produced or consumed.

Published 23rd January 2023, updated 30th November 2023

Every five to six years, the WCO reviews and revises the codes to account for changes in regulatory requirements, technology and trade patterns. Check for updates regularly to ensure your wine shipment is correctly classified and compliant with current regulations.

Some common mistakes include misclassifying your wine, not properly vetting the customs broker or freight forwarder and using an outdated code. It's important to thoroughly understand the product and its components when choosing an HS code.

A ruling is an official interpretation by Customs and Border Protection of the HS code assigned to a product. This ruling provides guidance on how to classify similar products. Rulings can be overturned or updated, so check for changes.

Different wines may have different duty rates based on alcohol content, country of origin or production method. Trade agreements or preferential treatment programs may impact rates, so use resources like the USITC Tariff Database or Customs Info Database to stay up to date.