Share this post

Will wine sales be hit by new UK alcohol duty changes?

As a wine importer you probably know that the UK, one of the world’s top wine importing markets, has announced the biggest reform of alcohol duties in more than 140 years.

But how will it work, what does it mean for wine sales and what does it mean for you? Read on to find out what’s changing.

What is UK alcohol duty, and when is it changing?

Alcohol duty is a tax, based on volume or alcohol degree, paid by companies that produce or import alcoholic beverages.

But the way the UK calculates alcohol duty will change significantly from 1st August 2023. At the same time, it will lift a four-year freeze on alcohol duty.

The new alcohol duty system in the UK

Generally, the new rule is the higher the alcohol degree, the higher the duty. Except products with 3.5%-8.4% alcohol by volume (ABV), drinks will be taxed according to alcohol content.

A brief history of alcohol duty in the UK

Until now, alcohol was classed in four categories: beer and cider, spirits, wine, and sparkling wine and fortified wine with different duties applying to each category.

Only beer and spirits are taxed according to ABV. Duty on cider, wine, and fortified wine is generally based on overall beverage volume. But in specific bands increased alcohol attracts increased rates. Sparkling wines are also banded differently. The result is varied tax rates for products with the same strength.

How will the new UK alcohol duty system work?

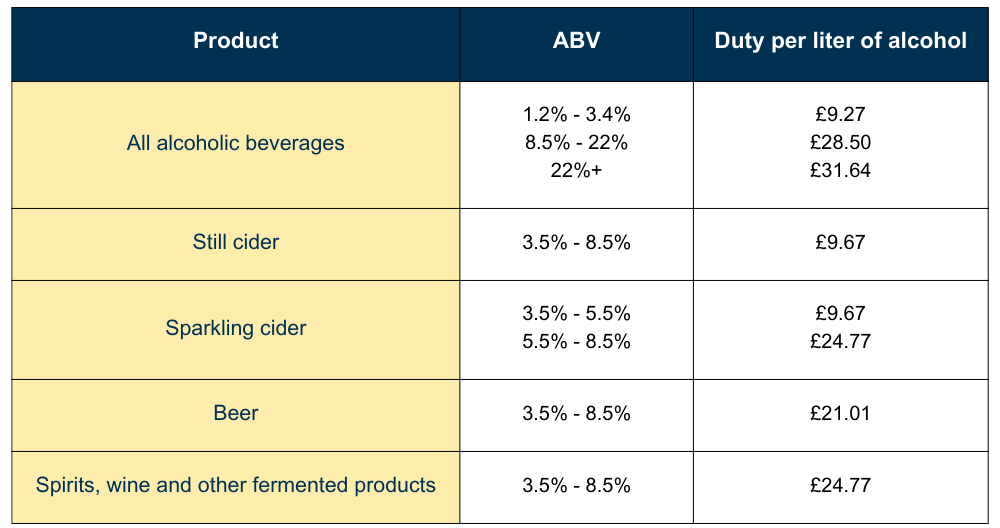

The reform simplifies the complicated banding system, reducing the number of duty bands from 15 to 6 and standardizes duties for almost all alcoholic beverages.

An increase in duty of at least 9% will hit around 90% of all still wine products. The lifting of the freeze adds another 10.1% to the price. In total, wine importers face a 20% tax increase.

What are the new UK alcohol duty bands?

Let’s have a more detailed look at the new rates of duty.

For wine there will be an adjustment period from 1st August 2023-1st February 2025, when the duty for 11.5%-14.5% ABV wine will be calculated as 12.5% ABV.

New UK draught relief and Small Producer Relief

The changes may be most keenly felt by small businesses and independent producers with fewer resources to spare.

They will have to work out how the revisions apply to their drinks and affect their pricing. They’ll also need to retrain employees and update their systems to accommodate the changes.

On the upside, there are new measures that could help them.

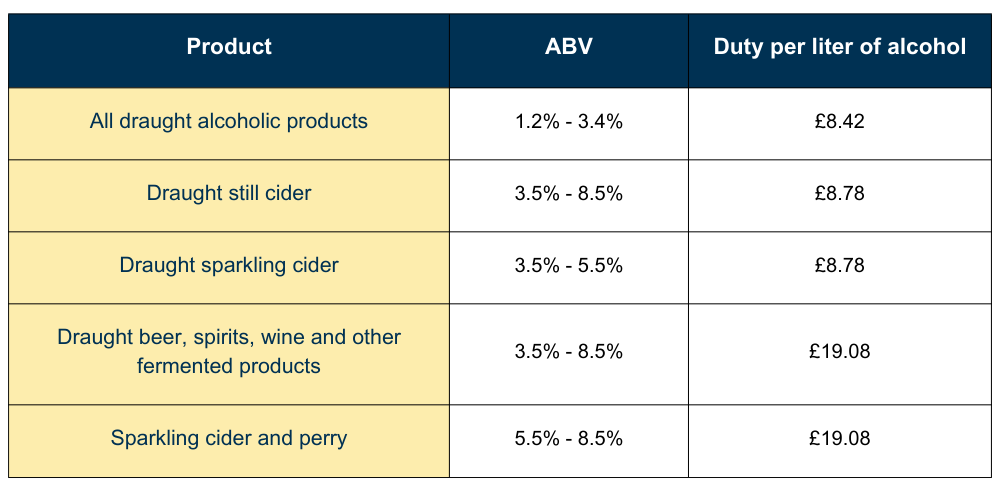

For pubs, clubs and bars, a draught relief with a lower rate of duty will apply to beverages sold on-premises. Beer and cider below 8.5% ABV in containers of at least 20l get a 9.2% decrease and a 23% discount applies to certain wine sales, spirits and fermented drinks.

Here's a breakdown of how the draught relief will work:

Another step is the replacement of the Small Brewer Relief with the Small Producer Relief. Those who produce up to 4,500hl of wine, cider, spirits, or fortified wine under 8.5% ABV will enjoy the same benefits as brewers.

How will the new UK alcohol duty system affect consumers?

If wine businesses choose to pass the increases onto consumers, wine drinkers will face the largest price rise in almost five decades.

Duty on a bottle of still wine over 12.5% ABV will increase by 44p. Most wines contain at least 12% ABV, so many will be affected. Fortified wines like port will be hit with a rise of £1.30 per bottle. However, sparkling wine at 12% ABV will drop by 7p so Champagne, Cava, and Prosecco could see lower prices, but maybe not enough to increase wine sales.

While the price of spirits is likely to increase, with the duty on a bottle of vodka expected to rise by 76p, the duty on some lower-strength drinks will fall. For example, a pre-mixed can of Gin & Tonic with 5% ABV will drop 14p.

Pub drinkers will save on draught beer and cider as the increased draught relief rate for venues will offset standard alcohol duty by 9.2%. So, the duty on a pub pint will be 11p less than beer from a shop.Why has the UK alcohol duty system changed?

The government thought the existing duty system, where products of similar alcohol degree get different tax treatments, was outdated and inconsistent. The changes are also intended to reduce paperwork for producers paying duty and complying with excise requirements.

Another aim is to improve public health by promoting responsible drinking.

It will take time for the industry to adjust to the new regime but Richard Corbett, from International Wine Spirits Research, warned the effects will be varied.

“The principle of drinks being taxed in line with alcohol content seems fair, but inevitably there will be winners and losers,” he said.

“Some products will have been taxed too highly historically and other products too lightly”.

How will the new UK alcohol duty system affect wine sales?

It’s unlikely many British wine drinkers will be too put off by price increases. The UK is the third biggest importer and fifth-largest consumer of wine in the world. Plus, it’s the country’s most popular alcoholic drink.

What’s more, consumers tend to see higher prices as a sign of quality wine and strong brand equity usually means shoppers continue buying their favorite beers, wines, and spirits in spite of price rises.

If you’re interested in importing wine into the UK, or any other country, a specialist freight forwarder like Hillebrand Gori can help you navigate red tape like alcohol duty and take the stress out of running a wine importation business.

If you’d like to know more about how the UK’s new alcohol duty system might affect you, contact your local Hillebrand Gori office for more information.

Published 31st May 2023, updated 22nd February 2024

No, industry experts predict global revenue for wine to increase by $79.9 billion (23.94%) through 2027. Projections for 2027 estimate revenue to reach $412.9 billion.

Experts project shifting consumer preferences towards organic or sustainable wines, the rich diversity of wine-producing regions, and the increasing popularity of wine tourism to drive market growth in the wine industry.

The historic reform of alcohol duties in the UK signifies a shift towards simplifying and modernizing the current system. This means that wine importers will face reduced administrative burdens, allowing them to focus on growing their businesses and meeting consumer demand.

Some proactive steps wine importers can take to adapt to the changes and ensure compliance include staying updated on the latest regulations and requirements, maintaining accurate records of imports and sales, and working closely with logistics partners, like Hillebrand Gori, to streamline processes.

How can we help your business grow?