Share this post

State of the Industry 2020: Ocean Shipping Weathers the Pandemic

2020 remains a grim year for the world. The ongoing impact of the reaction to the COVID-19 pandemic has plunged the global economy into the deepest recession of the century, deeper than the 2008 financial crisis and eclipsed only by the Great Depression of the 1930s.

World GDP is forecasted to shrink by -5% this year, -8% for mature economies. In Q2 alone, the GDP of OECD member countries dropped a staggering -9.8%. Q3 and Q4 predictions are equally gloomy. There’s no question that such an extreme state of affairs has and will impact container freight demand.

Container Demand Plummets, Disruption of Trade Routes and Global Supply Chains

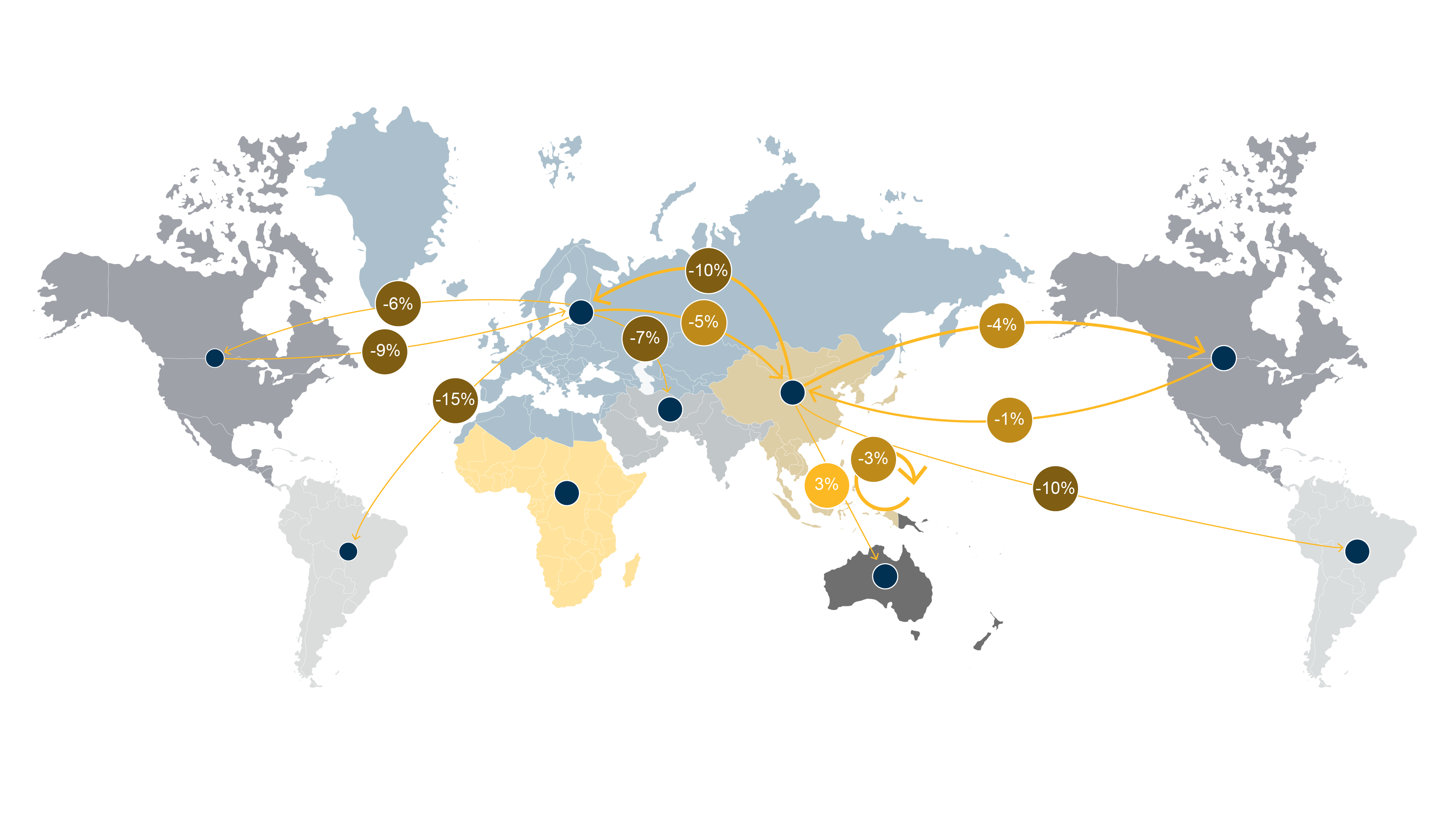

The global container industry lost over 5.7 Million TEUs cargo capacity in the peak COVID-19 pandemic and lockdown period of Jan-July 2020 in comparison to 2019; equivalent to an average of -7%. The trade routes most affected were Asia to Europe, Asia to South America and Europe to USA, amongst others.

Estimated global container volumes YTD August : -6.9%

The trade route disruption was driven primarily by shuttered factories, nationwide lockdowns and a steep drop in non-essential spending; all in reaction to COVID-19. The disarray cascaded down the entire supply chain, which has been constantly finding new ways to adapt to todays situation. At the peak of the globally imposed lockdowns, shippers faced voided (blank) sailings, port congestions, reversing trade imbalances and workforce and container shortages. Today, ports and carriers are still trying to keep up with a backlog of operations, which in itself is causing delays. Furthermore, the coronavirus pandemic is still very much in force that the industry needs to learn to adjust to and the progress of this can be seen in the transformation currently taking place.

The trade route disruption was driven primarily by shuttered factories, nationwide lockdowns and a steep drop in non-essential spending; all in reaction to COVID-19. The disarray cascaded down the entire supply chain, which has been constantly finding new ways to adapt to todays situation. At the peak of the globally imposed lockdowns, shippers faced voided (blank) sailings, port congestions, reversing trade imbalances and workforce and container shortages. Today, ports and carriers are still trying to keep up with a backlog of operations, which in itself is causing delays. Furthermore, the coronavirus pandemic is still very much in force that the industry needs to learn to adjust to and the progress of this can be seen in the transformation currently taking place.

How Ocean Carriers Adapted

Anticipating major industry collapse, the Carrier Alliances showed remarkable discipline in aligning supply with demand as early as February; removing trade capacity from the seas by halting vessels and shipments. By doing so, the erosion of ocean rates was kept to a minimum. Basing their reaction on potential worst case scenarios, shipping carriers artificially created under-capacity. This made available space come at a premium and therefore significantly raised the cost of container shipping, stabilizing revenues for carriers.

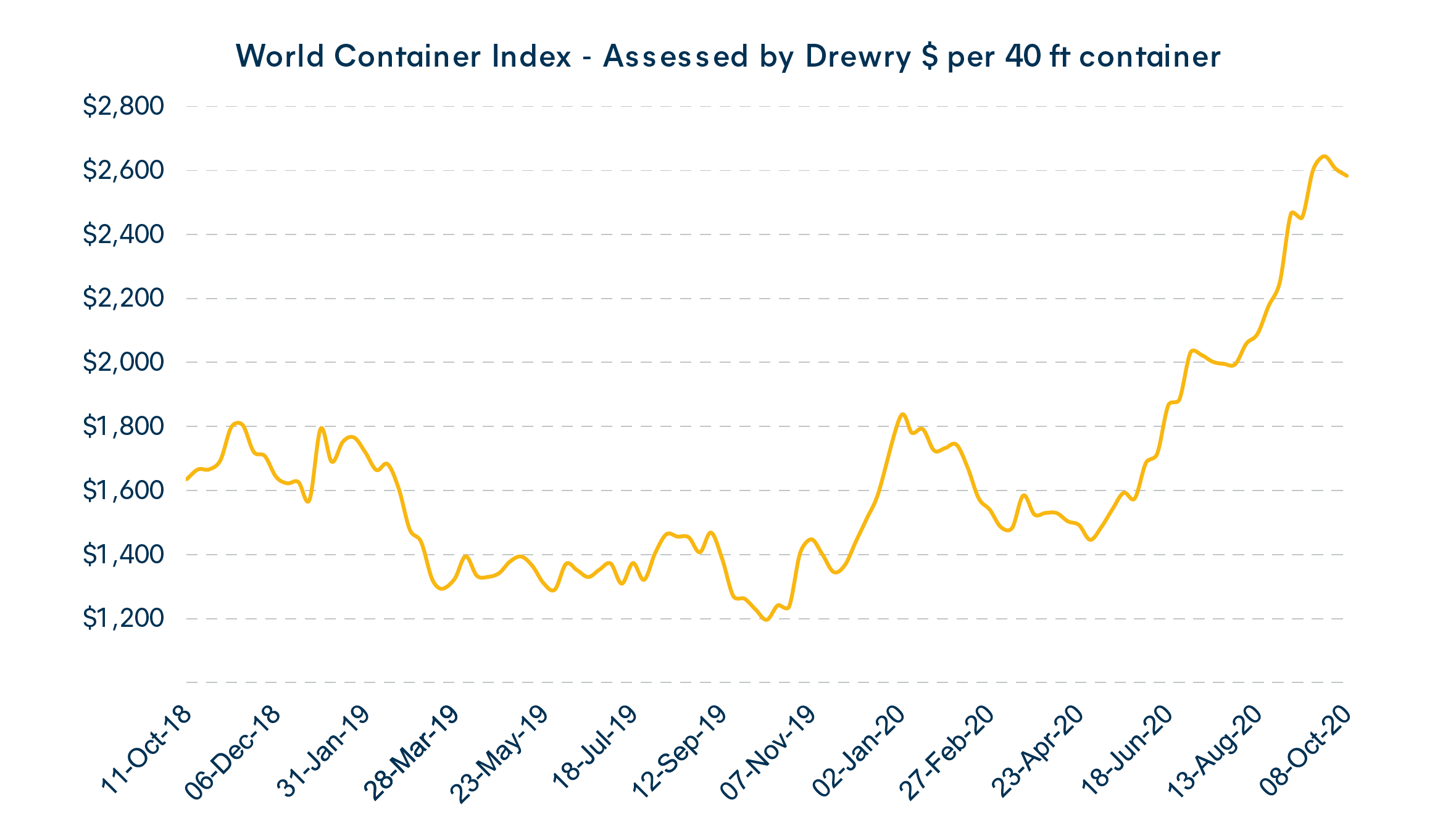

Freight rates have been steadily rising on all East to West shipping routes since May. At the end of August, the Shanghai Freight Index tracked a +16 % uptick from July, +40 % from May, and +53% up from last year, with the highest rate upturn hitting the Transpacific. The Drewry World Container Index is currently at its highest in four years.

World Container Index Assessed by Drewry

Besides effectively raising shipping rates, carriers saved on operational costs through several successful strategies, bolstered by record low fuel prices caused by the COVID-19 induced oil crash. The first move of the carriers was to send cargo ships around the Suez Canal to sail via the Cape of Good Hope instead. Although voyage distance and time was significantly increased, low fuel prices meant that it made more financial sense to take this longer route and bypass the high Suez toll fee. In reaction to this, and to avoid losing business to the Panama Canal, the Suez Canal actually lowered their fees significantly - an added boon for carriers. Secondly, carriers opted for bunkering points in more far flung, cheaper locations. Again, all made possible thanks to plummeting oil prices.

2021: What’s Next for the Shipping Industry?

Based on current setups and trends, freight carriers are likely to continue with tight dynamic capacity control (and higher freight rates) to respond to the volatile and very uncertain demand ahead. While this entails operational constraints such as delays, roll-overs, congestion, equipment supply and free times pressure to name but a few; it also means a profitable outlook for the freight industry as a whole. Accurate forecasts, reliability and commitment will become key to outperforming the competition. All in all, although the future is highly uncertain, the freight industry is robust and connected enough to weather even a global crisis.

How can Hillebrand support you in this situation?

We encourage you to cover your products with a shipping insurance, to ensure your peace of mind and be prepared to face any unexpected situation.

When possible, consider alternative solutions such as intermodal freight solution, rail from Europe to Asia or airfreight for urgent orders.

We understand the risks for your goods if delays occur at ports with high temperatures. In a situation of temperature-controlled containers shortage, we can help protect your wines and beers with our insulation liner which reduces temperature contrast to an average of 8-11 degrees*.

Hillebrand has over 50 warehouses in main wine producing and beverage consumptions areas, where you can store your beverages and goods safely with our temperature-controlled facilities.

.png?sfvrsn=3cd76ea1_1)